ISSN: 2511-7602

Journal for Art Market Studies

ISSN: 2511-7602

Journal for Art Market Studies

David M. Challis

Japanese art collectors acquired a large number of Rodin’s sculptures in the 1920s. While recent exhibitions have detailed the increasingly favourable critical reception of Rodin’s oeuvre in Japan during the early twentieth century, the underlying economic context behind the translocation of Rodin’s sculptures from Paris to Japan has remained largely unstudied. This paper argues that the collapse in the value of the French franc, among other economic disruptions occurring in France during the 1920s, played a significant role in the timing and scale of this translocation. The paper draws on board reports from the archives of the Musée Rodin in Paris and quantitative currency data recorded by the United States Federal Reserve Bank to examine the demand and supply characteristics of the market for Rodin’s sculptures in Japan. This analysis provides the alternative perspective within which the dynamics of art market translocations can be further understood.

A distinguishing feature of the art market in Paris during the 1920s was an influx of international collectors from outside continental Europe who, in many cases, benefited from a currency advantage against the weakened French franc. Recent major exhibitions have examined the increasingly favourable critical reception of French modernist art outside of France and the role of entrepreneurial Parisian art dealers in successfully developing international client bases during this period.1 However, the specifics of the economic context underpinning the international demand from outside Europe remains less studied. By drawing on archival board reports from the Musée Rodin and currency data collected by the United States Federal Reserve Bank, this paper considers key aspects of the sale of a large number of Rodin’s sculptures to Japanese collectors between 1918 and 1931. The paper argues that the collapse in the value of the franc, among other economic disruptions occurring in France during the 1920s, played a significant role in the timing and scale of the translocation of Rodin’s sculptures to Japan. The demand and supply characteristics of the market for Rodin’s sculptures in Japan are examined through the analysis of two significant transactions between the Musée Rodin and the Japanese art collector, Kojiro Matsukata. The success of these transactions emboldened the Musée Rodin to appoint Hermann d’Oelsnitz as their commercial agent in Japan, whose successful sales campaign abruptly ended with the sudden devaluation of the Japanese yen in December 1931. Foregrounding the economic context underlying the sale of Rodin’s sculptures to Japanese collectors in the 1920s provides an alternative perspective within which the dynamics of art market translocations can be further understood.

It is important to preface the discussion by noting that the translocation of Rodin’s sculptures to Japan in the 1920s was emblematic of a much broader dispersion of cultural objects from an economically weakened Europe to a geographically diverse group of international collectors.2 This broader translocation, which has variously been described as a “catastrophic diaspora” and a “booming export market for France,” was driven by a number of factors in addition to the devaluation of the French franc.3 Many of these, including the international expansion and increasingly sophisticated marketing of Parisian art dealers; the evolution of art market institutions; and the importance of price discovery through public auction results, have been examined in detail by various authors.4 More recently, Euwe and Oosterlinck have also discussed the “flight into art” by domestic collectors in economies experiencing rampant inflation.5 Although their research focused on the Netherlands between 1939 and 1945, a similar demand from French art collectors was another aspect of the demand dynamics prevalent in the 1920s Parisian art market. The “flight into art” phenomenon may also explain the active participation of German art collectors in the market for French modernist art in the early 1920s despite the severe devaluation of the German mark.6 Rodin’s sculptures were chosen for the case study in this paper because of the Musée Rodin’s frequent dealings with international collectors and the detailed transactional records contained in the museum’s unpublished archival board reports. These records were necessary to enable the analysis of art market sales in relation to the devaluation of the franc, which is the specific focus of this paper. Other examples of economically motivated translocations could certainly be identified in Germany, Russia and other European countries during the interwar period.7

Much of the scholarly literature written to date on Rodin’s oeuvre in Japan has centred on the critical reception of his work.8 To the extent that the translocation of Rodin’s sculpture to Japan has been studied, the focus has been on the involvement of significant Japanese collectors and the central role performed by the art dealer, Hermann d’Oelsnitz.9 In the 2001 exhibition, Rodin in Japan, Hajime Shimoyama documented the entry of Rodin’s sculptures into Japan as occurring in three distinct phases.10 The first phase, in the 1910s, was characterised by an increasingly favourable critical reception of Rodin’s oeuvre among Japanese art critics, local art teachers and a number of expatriate artists returning to Japan from France.11 Shimoyama identified literary groups, such as Shirakaba and Subaru, as important cultural modalities for propagating Rodin’s popularity in Japan at this time. In November 1910, the editors of Shirakaba published a special issue dedicated to Rodin, sending him a personalised copy and a series of Japanese prints for his seventieth birthday.12 In response, Rodin sent back three small bronze sculptures, which are recorded as the first of Rodin’s sculptures to enter Japan.13 The exhibition of these sculptures by Shirakaba appears to have been the only public exhibition of Rodin’s work in Japan prior to the end of World War I, with photographic reproductions being the only other representations of his work available.14

In Europe and America, the reception for Rodin’s oeuvre lapsed into a period of critical decline after his death in 1917. With a turn toward more monolithic and abstract sculpture emerging, Rodin’s preoccupation with sentimental and accessible subject matter and his loose modelling style came to be seen as outdated.15 This lull was mirrored to some degree in Japan, with a number of contemporary Japanese sculptors expressing their preference for the sculptures of Aristide Maillol and Constantin Brancusi.16 However, outside of this immediate circle of art world insiders, interest in Rodin remained robust. The most obvious expression of his ongoing popularity was the accelerating demand for his sculptures in the early 1920s among wealthy Japanese businessmen, such as, Kojiro Matsukata, Ohara Magosaburo and Kishimoto Kichizaemon.17 These private art collectors were responsible for a second phase of activity that resulted in significant collections of Rodin’s sculpture being assembled in Japan. In an interview for the New York based magazine, International Studio, conducted in April 1922, Kojiro Matsukata stated he already owned in excess of 1,700 European artworks, including ten marbles and forty bronzes by Rodin.18 Many of the collections of European artwork currently belonging to public art museums in Japan were seeded from the artwork acquired by these collectors in the 1920s.19

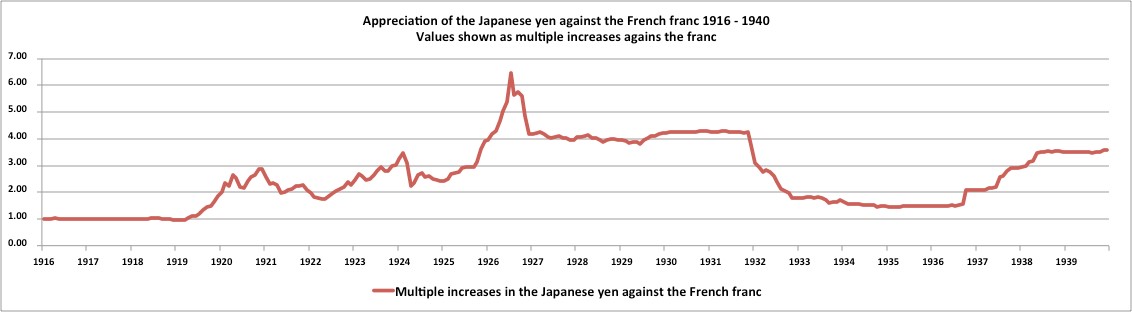

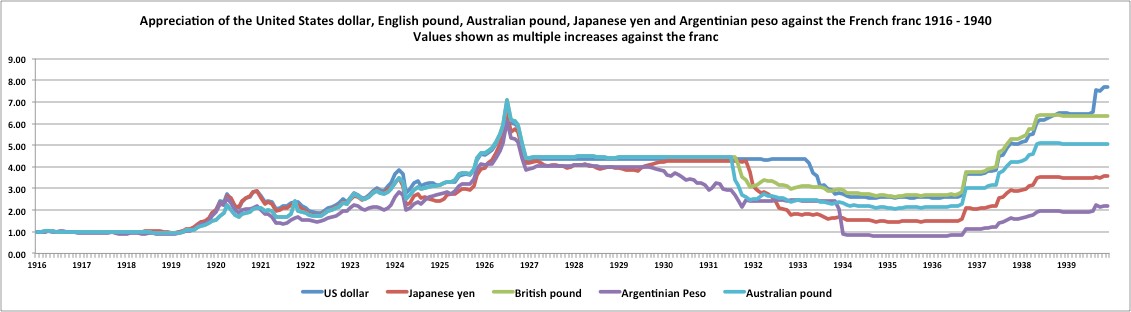

The timing of this increased collecting activity in Japan coincided with the collapse in the value of the French franc. In order to fund its war effort, and to accelerate post-war reconstruction, the French government implemented an aggressively expansive monetary policy between May 1915 and December 1925.20 However, the Bank of France’s expectation that the increase in money supply would be neutralised by the payment of German war reparations was never realised and the monetary stimulus resulted in an episode of rampant price inflation, which peaked at 350% per annum in 1926.21 The expanded French money supply also had significant repercussions for the French currency. France’s withdrawal from the International Gold Standard at the start of World War I uncoupled the value of the French franc from its fixed value against gold. As such, the increase in money supply resulted in the franc’s value against gold falling by eighty percent between 1919 and 1926.22 As a result, currencies that maintained their fixed value against gold dramatically increased in value against the franc over the same period. Figure 1 shows the multiple increases in the value of the Japanese yen against the French franc between 1916 and 1940. Prior to the war, under the International Gold Standard, the exchange rate between the two currencies was fixed at a ratio of approximately three francs to one yen. By July 1926 the yen had appreciated against the franc to an exchange rate of nineteen to one, a 630% increase compared to pre-war values. This increase stabilised at a rate of 400%, until the yen’s own significant devaluation in December 1931.23

Fig. 1: Source: the author using data from: FRASER®, Federal Reserve Archives, Federal Reserve Bank of Saint Louis.

The yen’s dramatic increase in value against the franc had significant consequences for Japanese art collectors. In essence, the increased purchasing power of the yen immunised Japanese collectors against the worst of the price inflation in France and gave them a substantial comparative advantage against collectors in France and other European countries experiencing similar currency devaluations after the war. Many of the Japanese private collectors who started acquiring Rodin’s sculptures in the early 1920s were senior businessmen that operated internationally in the banking, textile and manufacturing sectors. They were therefore ideally placed to understand the prevailing economic conditions in Europe, particularly the fluctuations occurring in the foreign exchange market.

As President of the Kawasaki Dockyard Company, Matsukata experienced an extended period of financial success from supplying battleships to the allied forces during the First World War.24 While living in London during the war, Matsukata formed a business relationship with the art dealer, Paul Durand-Ruel and the director of the Musée Luxembourg, Léonce Bénédite. Both men were subsequently retained by Matsukata to act as his agents in assembling his collection of French modernist artwork. Bénédite’s appointment as the director of the Musée Rodin in 1918, after Rodin’s death in November 1917, led almost immediately to negotiations for Matsukata to acquire a large group of Rodin’s sculptures.25 Given the recent acquisition of Rodin’s work by a number of international public collecting institutions, the opportunity to acquire a representative collection of the recently deceased artist’s oeuvre would undoubtedly have been viewed very favourably by Matsukata.26 However, an analysis of the financial elements of this transaction also reveals the extent to which the purchasing power of Japanese collectors increased in the early 1920s.

In August 1918, Matsukata contracted to buy thirty-eight bronze sculptures from the Musée Rodin for a total of 730,400 francs.27 The group of sculptures ranged from busts and smaller sculptures to monumental works, such as: The Burghers of Calais, The Large Thinker, Adam, Eve, The Age of Bronze, Saint John the Baptist and The Kiss. This sum represented a substantial price increase compared to the prices achieved by Rodin himself in sales of the same sculptures before the war.28 However, the staggered nature of the payments required to be made by Matsukata over a two-year period proved to be extremely advantageous to him. At the time of contracting, the value of the franc to the Japanese yen was 3.05 francs for one yen, equating to a total cost of 239,475 yen. As the value of the franc fell to almost 7 francs for one yen over 1919 and 1920, the payments actually made by Matsukata equated to a total of only 148,048 yen.29 This amounted to a net saving for Matsukata of 91,427 yen, or thirty-eight percent of the original price.

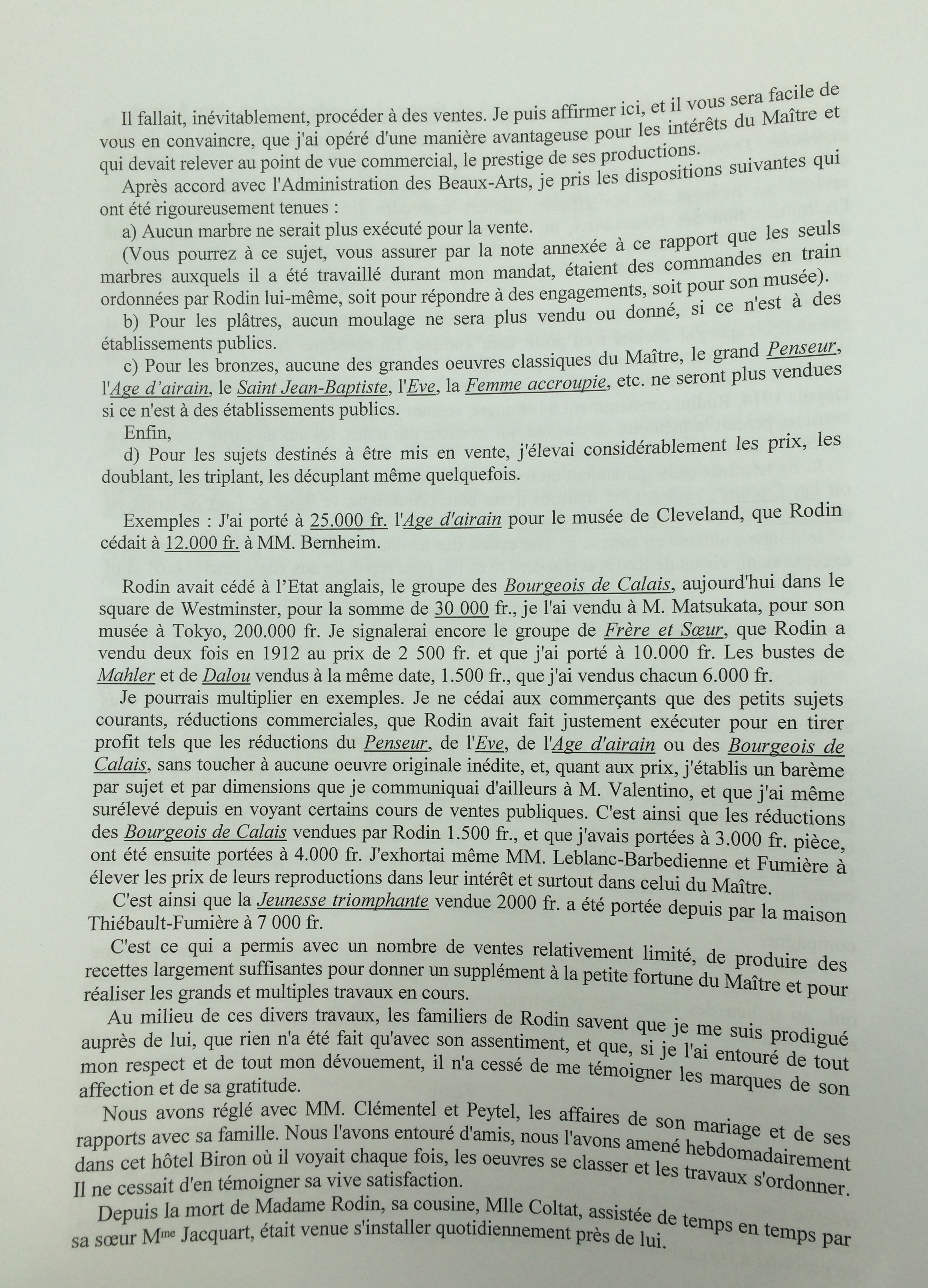

Fig. 2: Example of a page from the transcripts of the Musée Rodin’s Board Reports, the original report was dated 26 March 1919

While there is no evidence to suggest that Matsukata intended to speculate on a fall in the value of the franc, the extent of his savings clearly demonstrate the substantial financial advantage gained from the franc’s collapse. The scale of this saving can be further contextualised by considering Matsukata’s next acquisition from the Musée Rodin. Only eight months after finalising the first transaction, Bénédite announced at the October 1920 board meeting that Matsukata had signed a new contract to purchase a bronze edition of Rodin’s seminal work, The Gates of Hell, for a cost of 600,000 francs. Using the October 1920 exchange rate of 7.85 francs for one yen, Matsukata’s saving on his first transaction of 91,427 yen, now equated to 717,701 francs. This was enough to acquire Rodin’s largest and most prestigious sculpture with a residual of over 100,000 francs.30

Matsukata divulged to Bénédite his intention to use his substantial collection of European art to open a museum of Western modern art in Tokyo.31 At face value, this could be perceived as indicating that Matsukata believed the emerging modernist art movement in Japan would benefit from the presence of Rodin’s sculptures. However, when asked in his 1922 interview with International Studio what his motivations were for collecting Western art, Matsukata responded that his collecting was not influenced by Western aesthetic trends, saying: ‘I care nothing about your controversies over different schools of art; I buy examples of them all, for all are expressive of your psychology.’32 Matsukata went on to divulge that the purpose of his collecting was of a more pecuniary nature, stating: ‘to enable my countrymen to understand the psychology of Western peoples. It will help them in the application of Occidental methods in manufacturing, and in many phases of industrial life.’33 Taking these statements into account, combined with the concurrent devaluation of the franc, Matsukata’s acquisitions are more accurately seen as strategic appropriations from an economically weakened France, rather than the consequence of any form of Western cultural imperialism.

While the elevated purchasing power of the yen in the 1920s clearly advantaged Japanese collectors, consideration of the Musée Rodin’s circumstances show that the economic imperative was similarly influential in expediting the supply of Rodin’s sculptures to Japan. The Musée Rodin opened to the public in the Hôtel Biron as an independently funded museum on 4 August 1919. The new museum’s survival was immediately challenged by the episode of rampant inflation experienced in France in the early 1920s. Léonce Bénédite was required to immediately raise funds to meet the museum’s rising infrastructure, operating and foundry costs. Fortunately, Rodin’s donation to the French state, a year before his death in November 1917, encompassed: ‘all of his own works, including drawings, paintings, and sculptures, as well as copyrights pertaining to them.’34 The copyrights were of crucial importance to Bénédite who realised that selling bronze casts of Rodin’s sculptures would be necessary to ensure the financial survival of the museum.35

At the museum’s first board meeting in March 1919 Bénédite moved to formalise this source of income whilst also acting to secure Rodin’s artistic integrity. The board resolved that Rodin’s ‘classic sculptures’ in monumental size, such as The Large Thinker, The Age of Bronze, Saint John the Baptist, and Eve, would from that time on only be sold to public institutions as limited original bronze editions. However, bronze reductions of these, and other sculptures, were to be reproduced for commercial sale, at substantially increased prices.36 Bénédite intended to build a reserve fund of 2,000,000 francs, believing this would provide the museum with a passive income large enough to cover ongoing operating costs. Unfortunately, while accumulating this reserve, paying the museum’s operating costs and funding the cost of expanding the museum’s own collection of bronzes, the Musée Rodin experienced ongoing financial difficulties. George Grappe, who replaced Bénédite as the museum’s director in 1925, indicated how dire the museum’s financial position was when he advised the board on 9 March 1927 that the museum had accumulated a debt to the Rudier foundry of one million francs.37 In December 1934, Grappe conceded to the board that due to ongoing financial deficits the museum could only expect to survive as an independent institution for another eight years.38

Given its dire financial circumstances, Matsukata’s order for thirty-eight sculptures was financially transformative for the Musée Rodin. At a contract price of 730,400 francs, the profit from the transaction, after foundry costs, was 560,000 francs.39 This represented more than a quarter of the reserve fund that Bénédite hoped to accumulate. Other sales recorded in the museum’s board reports are described as being large enough to undertake urgent work at the museum, such as installing electricity and running water.40 Further evidence of the significance of commercial sales to the museum can be seen in board report entries where various strategies for marketing to international collectors are discussed. At the November 1926 board meeting, Grappe suggested the museum pay to have the sculpture of Balzac cast into bronze for the Musée Rodin’s own collection. He believed by doing so they were likely to induce Matsukata, and the American collector, Jules Mastbaum, to also order bronze editions of Balzac for their own collections.41 This idea was never approved and Balzac remained in plaster form until 1930. A full-scale plaster version of Balzac was, however, gifted by the museum to the Tokyo school of fine arts in 1927.42

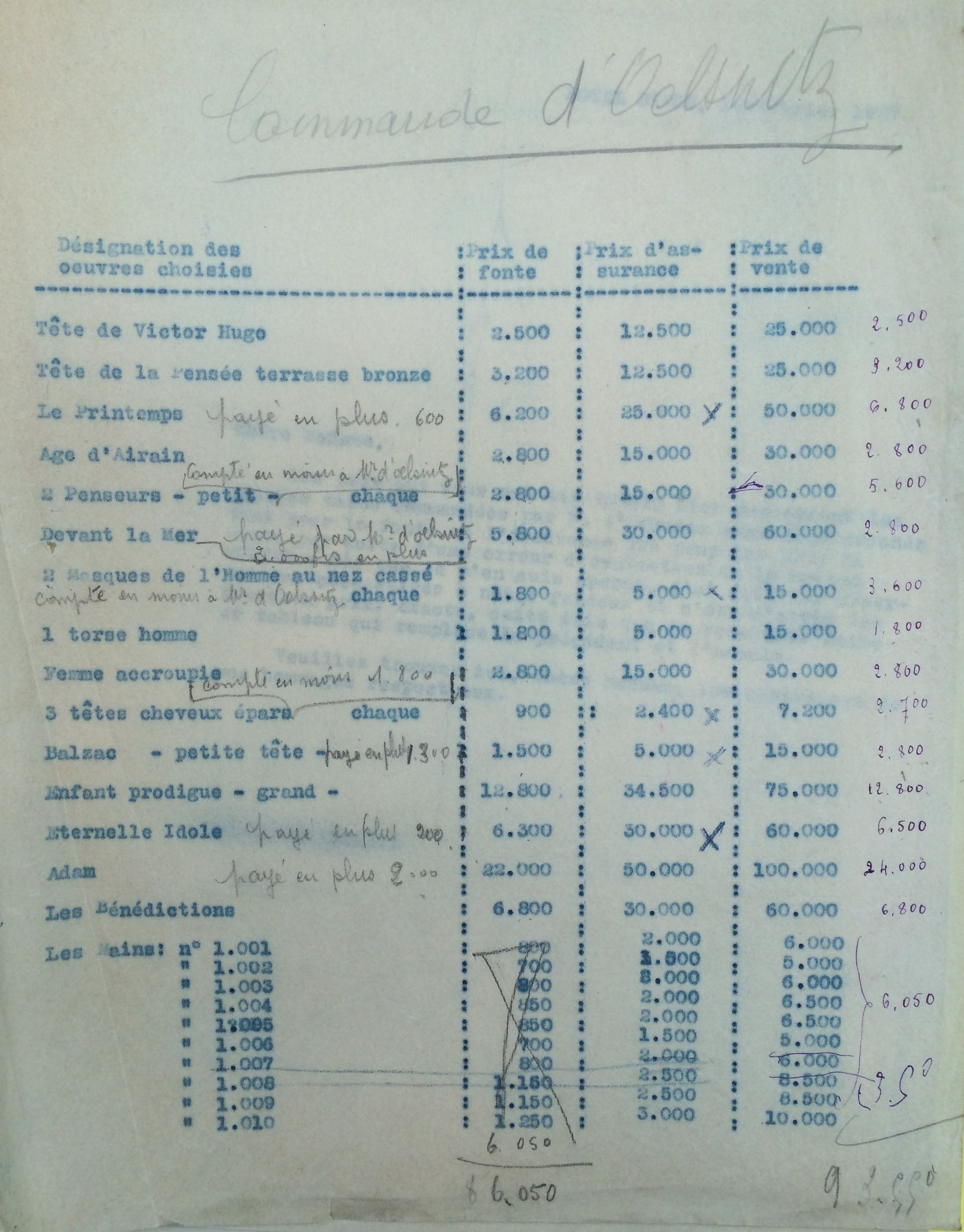

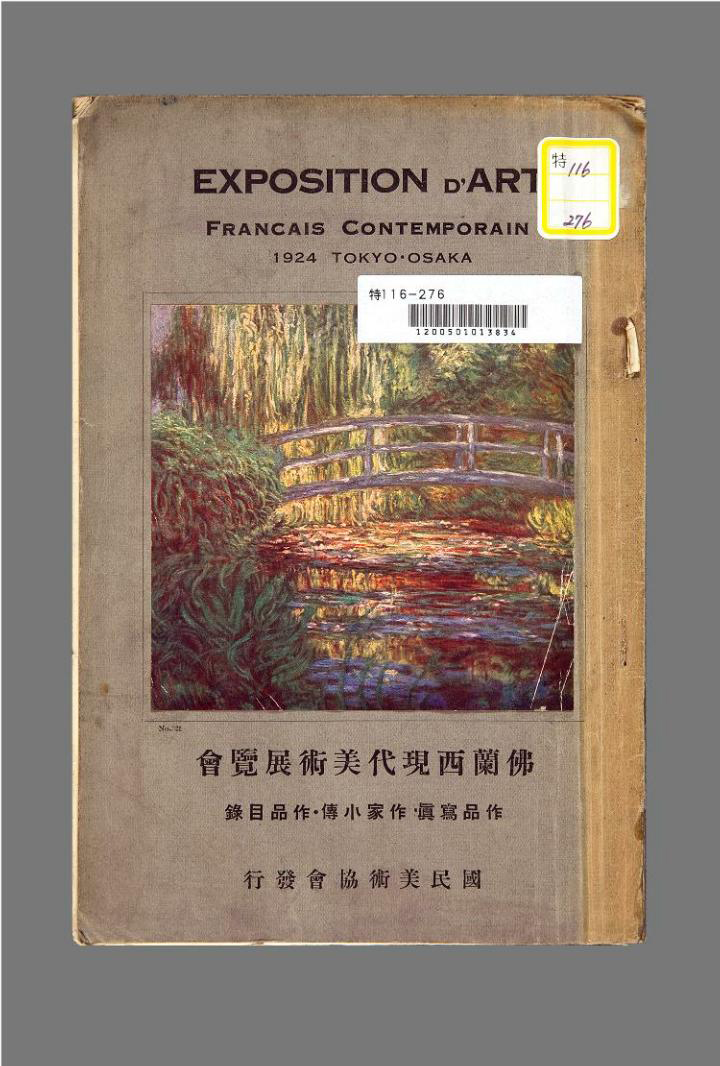

Emboldened by the successful transactions completed with Matsukata, it was not long before the Musée Rodin formalised a commercial relationship with the art dealer, Hermann d’Oelsnitz, to act as their commercial agent in Japan. From 1922 until 1931, D’Oelsnitz implemented a more structured sales campaign, which Shimoyama credits with fostering the third phase of Rodin’s sculptures entering Japan. D’Oelsnitz commenced his activity in Japan with the Exhibition of French Contemporary Art held annually between 1922 and 1927 with the support of the French ambassador to Japan, Paul Claudel, and the director of the Tokyo School of Fine Arts, Nao-Hiko Masaki.43 The exhibitions presented up to 500 works of art, including paintings, watercolours, sculpture, ceramics and glass (fig.4). Each year the exhibitions travelled from Tokyo to Osaka and, on one occasion, to Nagoya.44

While a formal record of the sales made at the six exhibitions has not been found, the board reports of the Musée Rodin from the 1920s demonstrate the scale and success of d’Oelsnitz’s operation. In November 1922, Bénédite informed the museum’s board that d’Oelsnitz recently made sales of: 90,000 francs to Mr. Kojima for the monumental sized sculptures, Saint John the Baptist and Jean d’Aire; 57,000 francs to a Japanese amateur, Baron Morimura; and 80,000 francs for small bronzes.45 These small bronzes were reproductions of various busts, masks and body fragments, which were very popular in Japan. One such item was a bronze reduction of the bust, The Man With the Broken Nose. In 1923 the Musée Rodin shipped 130 of these busts to d’Oelsnitz, which he offered for sale in Tokyo for 2,600 francs each.46 At the 1924 Exhibition of Contemporary French Art, the Tokyo National Museum acquired a full-scale original edition bronze of Rodin’s sculpture, Eve.47 This was the first sculpture by Rodin to be accessioned by a public collecting institution in Japan, further legitimising the favourable critical reception of Rodin’s oeuvre in the 1910s. At the end of the cycle of exhibitions in 1927, d’Oelsnitz opened his own commercial art gallery in Tokyo, where he continued to offer contemporary French artwork and represent the Musée Rodin.

Fig. 3: Caption to follow: extract of correspondence between d'Oelsnitz and the museum

Political and economic events in Japan in the early 1930s dramatically reversed the purchasing power advantage that Japanese collectors had enjoyed throughout the 1920s. Britain’s withdrawal from the International Gold Standard in September 1931 resulted in a 30% devaluation of the pound, which increased the competitiveness of British exports in the Asian region where Britain was a direct trading competitor with Japan.48 This, and the fiscal pressure on the Japanese government resulting from the military invasion of Manchuria in September 1931, created speculation in the foreign exchange markets that Japan would be forced to devalue the yen. When the governing Minseitō party lost their parliamentary majority in December 1931 after attempting to restrain military spending, the new government, formed by the Seiyūkai party, immediately withdrew from the International Gold Standard to avoid the contractionary policies required to defend the mounting pressure on the yen.49 Over the course of the next twelve months the value of the yen declined from an exchange rate of twelve francs to one yen to a rate of only four francs to one yen. D’Oelsnitz was forced into bankruptcy in December 1931, with outstanding debts to the Musée Rodin of 86,000 francs. Clearly his business model was not only predicated on a growing taste for Rodin’s oeuvre among Japanese collectors, but also on the purchasing power advantage enjoyed by them. The devaluation of the yen, the absence of d’Oelsnitz and Japans increasingly militaristic ambitions marked an abrupt end to the translocation of Rodin’s sculptures to Japan.

Fig 4: Cover of the catalogue for the Exhibition of Contemporary French Art, 1924, http://www.ndl.go.jp/france/common/img/part2/l_image_s2_2_13_01.jpg; source: National Diet Library website

The impact of the yen’s elevated purchasing power on the Musée Rodin’s sales to Japan can be seen as emblematic of the museum’s overall sales to international collectors during this period. The museum attracted collectors from a wide range of countries outside of Europe including the United States of America, Britain, Argentina and Australia, all of which had experienced similar appreciations in their currency relative to the franc (figure 2). Following 1931, as the full force of the social and economic consequences of the Great Depression were felt, the differing geo-economic circumstances of each of these countries led to a much greater variation in currency valuations against the franc. Notably, the Japanese yen was one of the poorest performing currencies while the US dollar was the strongest. This assisted American collectors, such as Jules Mastbaum in the 1920s and 1930s, and Gerald Cantor in the 1950s and 1960s, to assemble large collections of Rodin’s sculptures.50 Foregrounding the underlying economic context, particularly in relation to the collapse in the value of the franc, provides an alternative perspective within which the timing, scale and geographic dispersion of Rodin’s sculptures can be further understood.

Fig. 5: Source: the author using data from: FRASER®, Federal Reserve Archives, Federal Reserve Bank of Saint Louis.

The examples given in this paper also demonstrate that the art dealers and collectors involved, such as d’Oelsnitz and Matsukata, were in many ways opportunistically responding to the prevailing economic substructure, which significantly precipitated both the supply and demand for Rodin’s sculptures in Japan. D’Oelsnitz’s business model was clearly predicated on the strength of the Japanese yen in addition to the increasingly favourable reception to Rodin’s oeuvre in Japan. It also seems likely that the scale of Japanese collections, such as Matsukata’s, would have been reduced if not for the elevated purchasing power of the yen. Without the collapse of the franc in the aftermath of World War I, their activities are likely to have been substantially diminished. As such, understanding the impact of the underlying economic context on the behaviours of dealers and collectors provides a further insight into their activities and motivations.

Although the critical reception of Rodin’s oeuvre in Japan was increasingly favourable in the 1910s, the large-scale translocation of Rodin’s sculptures to Japan did not occur until the early 1920s when the elevated purchasing power of the yen fuelled a substantial demand among Japanese art collectors. At the same time, the supply of sculptures to Japan was expedited by the dire financial circumstances of the Musée Rodin, which compelled it to offer first edition bronzes and smaller reproductions of Rodin’s sculptures for commercial sale. Selling to international collectors, funded in currencies that were appreciating against the franc, became an obvious strategy for the museum. The economic imperative behind the translocation of Rodin’s sculptures to Japan is further evidenced by the abrupt end to the Musée Rodin’s sales in Japan following the devaluation of the yen in late 1931. The activities and motivations of the Musée Rodin, Herman d’Oelsnitz and Japanese collectors during this period can only be comprehensively explained with reference to a constellation of aesthetic, economic and political factors. However, within this set of circumstances, the elevated purchasing power of the yen played an important role in determining the timing and scale of the translocation of Rodin’s sculptures to Japan.

David Challis is a third year PhD candidate in the Art History School at Melbourne University.

1 Joseph J. Rishel, Katherine Sachs, Roberta Bernstein, Paul Cézanne, and Philadelphia Museum of Art, Cézanne and Beyond, (Philadelphia and New Haven: Philadelphia Museum of Art; In association with Yale University Press, 2009). Beate Marks-Hanssen and Kunst- und Ausstellungshalle der Bundesrepublik Deutschland, Japan’s Love for Impressionism: From Monet to Renoir, (Munich, London and New York: Prestel, 2016). Sylvie Patry, Christopher Riopelle, Joseph Rishell, Anne Robbins, Jennifer A. Thompson, Musée d’histoire et d’art (Luxembourg), National Gallery (London), and Philadelphia Museum of Art, Inventing Impressionism: Paul Durand-Ruel and the Modern Art Market, (Great Britain: National Gallery Company Ltd., 2015).

2 The US dollar value of exports of artwork from Europe to America increased by 750% between February 1919 and February 1920. See: Big Jump In Art Exports, in American Art News, Vol. 18, no. 29, 8 May 1920.

3 Robert Jensen, Marketing Modernism in Fin-de-Siècle Europe, (New Jersey: Princeton University Press, 1994), 7.

4 Malcolm Gee, Dealers, Critics and Collectors of Modern Painting. Aspects of the Parisian Art Market between 1910 and 1930, New York and London: Garland Press, 1981. More recently, Contemporary Art in Boom and Crisis: France and Germany 1918-1933, The Challenge of the Object/Die Herausforderung des Objekts: 33rd Congress of the International Committee of the History of Art Congress proceedings, German National Museum, Nuremberg, 2014, pp. 712-713, and an extended version of this paper recently uploaded to Academia.edu, https://www.academia.edu/34745810/Contemporary_Art_in_Boom_and_Crisis_France_and_Germany_1918-1933 (accessed 15/12/2017). Also, Patry, Inventing Impressionism, 2015.

5 Jeroen Euwe and Kim Oosterlinck, Art Price Economics in the Netherlands during World War II, in Journal for Art Market Studies, Vol. 1, No. 1, (2017), 51.

6 Germans buy French Art, in American Art News, Vol. 19, no. 11, (25 December 1920), 1 – 8.

7 For Germany: Dorothy Kosinski, G. F. Reber: Collector of Cubism, in The Burlington Magazine 133, no. 1061 (August 1991), 519–31. For Russia: Cynthia Saltzman, Old Masters, New World: America’s Raid on Europe’s Great Pictures, 1880-World War I (New York: Viking, 2008), 259.

8 Guth, Christine, Alicia Volk, Emiko Yamanashi, Redmond Entwistle, and Honolulu Academy of Arts, Japan & Paris : Impressionism, Post Impressionism, and the Modern Era (Honolulu, HI: Honolulu Academy of Arts, 2004). Also, Beate Marks-Hanssen, Japan’s Love for Impressionism, 2016.

9 Auguste Rodin, Shizuoka Kenritsu Bijutsukan and Aichi-ken Bijutsukan, in Rodin et le Japon, (Japan: Gendai Chōkoku Sentā, 2001).

10 Shimoyama, Rodin et le Japon, 79 - 82.

11 This was an almost textbook example of the modalities of cultural transfer described by John Clark in Modern Asian Art, 49 – 54. For a discussion of artists returning from Europe and Japanese literary societies see Michiaki Kawakita, Modern Currents in Japanese Art, (The Heibonsha Survey of Japanese Art, 1st English ed., New York: Weatherhill, 1974), 95 – 100.

12 Antoinette Le Normand-Romain, The Bronzes of Rodin: Catalogue of Works in the Musée Rodin, 2 vols, (Paris: Musée Rodin, 2007), 289.

13 Le Normand-Romain, The Bronzes of Rodin, 289.

14 Guth, Japan and Paris, 22.

15 Albert Elsen, Rodin, New York: Museum of Modern Art, 1963 and David Getsy, Rodin: sex and the making of modern sculpture (New Haven and London: Yale University Press, 2010).

16 Shimoyama, Rodin et le Japon, 80.

17 Shimoyama, Rodin et le Japon, 75 – 79; and Guth, Japan & Paris, 14 – 16.

18 Willard Slater, Why Japan Collects Western Art, in International Studio, vol. 75 (1922), 152. Note that only a portion of the 1,700 European paintings and sculptures acquired by Matsukata were shipped back to Tokyo in the early 1920s. Another portion was destroyed in a warehouse fire in London in 1939. A further 400 artworks, including many of the sculptures by Rodin, remained in France until 1959 when they were returned to Tokyo to form the cornerstone of the National Museum of Western Art.

19 Beate Marks-Hanssen, Japan’s Love for Impressionism, 2016, 208 – 232.

20 Kenneth Mouré, The Gold Standard Illusion: France, the Bank of France, and the International Gold Standard, 1914-1939 (New York; Oxford: Oxford University Press, 2002), 27 – 49. The legal limit on monetary advances to the state and notes in circulation were increased by a multiple of four between May 1915 and December 1925. See table 2.1 on p. 32.

21 Barry J. Eichengreen, Golden Fetters : The Gold Standard and the Great Depression, 1919-1939 (Nber Series on Long-Term Factors in Economic Development, New York: Oxford University Press, 1992), 172.

22 Mouré, The Gold Standard Illusion, 9.

23 The data points for the currency charts used in this article were calculated using the monthly exchange rates recorded by the Federal Reserve Bank in the United States for US dollars against the French franc and US dollars against the Japanese yen, between 1916 and 1940. These exchange rates were used to calculate the arbitrage free cross rate between the French franc and Japanese yen. Using January 1916 as the base month, the multiple increases in the value of the yen against the franc during each month was then calculated. Note that the physical exchange of gold under the International Gold Standard did, on occasions, give rise to arbitrage margins occurring between various currencies. These margins are not reflected in the charts. FRASER®, Federal Reserve Archives, Federal Reserve Bank of Saint Louis. https://fraser.stlouisfed.org/scribd/?toc_id=334470&filepath=/docs/publications/bms/1914-1941/BMS14-41_complete.pdf&start_page=403#scribd-open (accessed 15 September 2017).

24 Beate Marks-Hanßen, Japan’s Love for Impressionism, 219.

25 Beate Marks-Hanßen, Japan’s Love for Impressionism, 16 - 17.

26 Among others: the Metropolitan Museum of Art in New York, the Carlsberg Glyptothek in Copenhagen and the National Art Collection Fund in London. See Le Normand-Romain, The Bronzes of Rodin, 211.

27 Letter from Matsukata to Bénédite, 22 August 1918, Paris Bibliothèque Centrale des Musées Nationaux, MS 375, (6,5,1) 1, as cited in Le Normand-Romand, The Bronzes of Rodin, 40.

28 At the March 1919 board meeting, Bénédite reported that the price of the Burghers of Calais in the Matsukata contract was 200,000 francs compared to the 30,000 francs charged by Rodin to the English government for the same sculpture in 1908. Musée Rodin board report, 26 March 1919, Musée Rodin archives, Paris. NB As the original board reports manuscripts deteriorated, a typed transcript was made available by the museum.

29 175,000 francs paid in March 1919 at an exchange rate of 3.05:1 equates to 57,377 yen. 262,400 francs paid in December 1919 at an exchange rate of 5.45:1 equates to 48,146 yen. 293,000 francs remaining to be paid in February 1920 at an exchange rate of 6.89:1 equates to 42,525 yen. Making a total payment of 148,048 yen. Musée Rodin board reports, 5 May 1919, 24 December 1919, 27 February 1920, Musée Rodin archives, Paris, see fn. 28.

30 Musée Rodin board report, 2 October 1920, Musée Rodin archives, Paris, see fn. 28. Note: this contract was later renegotiated. In the end Matsukata paid between 600,000 and 700,000 for two editions of The Gates of Hell to be cast, one for Matsukata’s collection and one for the collection of the Musée Rodin. See Le Normand-Romain, The Bronzes of Rodin, 40.

31 Musée Rodin board report, 5 May 1919, Musée Rodin archives, Paris, see fn. 28.

32 Slater, Why Japan Collects Western Art, 151.

33 Ibid, 151.

34 Le Normand -Romain, The Bronzes of Rodin, 33.

35 Musée Rodin Board report, 19 March 1926, Musée Rodin Archives, Paris. See fn. 28.

36 Only bronze sculptures cast from original plaster or terracotta sculptures modelled by Rodin himself, offered in limited editions and identical in all aspects to the bronze sculptures approved by Rodin in his lifetime can qualify as ‘original editions in bronze.’ All other bronze casts are considered to be reproductions. For a full discussion on the status of Rodin bronze casts see Le Normand-Romain, The Bronzes of Rodin, 65 – 77.

37 Le Normand-Romain, The Bronzes of Rodin, 41.

38 Ibid, 43.

39 Musée Rodin board report, 5 May 1919, Musée Rodin archives, Paris. See fn. 28.

40 Board meeting, 9 November 1921, Musée Rodin Archives, Paris. See fn. 28.

41 Board meeting, 18 November 1926, Musée Rodin Archives, Paris. See fn. 28.

42 Francois Gaborit, Hermann d’Oelsnitz, merchant of art in Japan for the Musée Rodin, in the 1920s, in Bulletin de la Société de l’Historie de l’Art Francais, January, (2010), 308.

43 Shimoyama, Rodin et le Japon, 80. In 1922 d’Oelsnitz was working in partnership with the art dealer Bernheim-Jeune, but this seems to have dissolved after the first year. See Gabroit, Hermann d’Oelsnitz, 296.

44 Shimoyama, Rodin et le Japon, 80.

45 Musée Rodin board report, 30 November 1922, Musée Rodin archives, Paris. See fn. 28.

46 Le Normand-Romain, The Bronzes of Rodin, 416.

47 Gaborit, Hermann d’Oelsnitz, 299.

48 Eichengreen, Golden Fetters, 279 – 285.

49 Eichengreen, Golden Fetters, 300 – 309.

50 Le Normand-Romain, The Bronzes of Rodin, 40 – 57.